According to the Thrift Supervision National Housing Forum that was held on December 8, the re-default rate of modified loans (which represent about 60% of all the loans), loans modified in the first quarter of this year after 3 months only nearly 36% of them defaulted again by being past 30 days late; after 6 months the re-default rate is 53% and after 8 months, it’s 58%. For the second quarter, the re-default rates are about the same. More than half of the modified loans are defaulting again, I believe it is an indication that loan modification is not working. Whether it’s due to the lack of principle reduction or simply economy in crisis, we wouldn’t be able to determine. Most likely, all of the above.

Source: CNBC.com

http://www.cnbc.com/id/15840232?video=955168734

Wednesday, December 10, 2008

Wednesday, November 19, 2008

HOW TO BUY A HOUSE WITH NO DOWNPAYMENT

How To Buy A Home With Zero Down

Las Vegas: A new home ownership program allows qualified buyers to buy a home with absolutely no down payment.

You may have owned a home before and are presently renting, or maybe you are a first time homebuyer and need a way to break into the housing market but are holding back because you think you require $10.000, $20.000 or even more for a down payment.

Well regardless of your present situation, if you want to get into, or re-enter the housing market without having to make a cash down payment, this new program may be just what you're looking for. Why pay your landlord's mortgage when you can be building your own equity.

Industry insiders have prepared a new special report entitled, "How to Buy a Home With Zero Down' which reveals how this new and innovative program can get you into the housing market immediately and with no down payment.

To get your FREE copy today visit

www.LVRealDeal.com

or call 877-583-1181 ID#712

Las Vegas: A new home ownership program allows qualified buyers to buy a home with absolutely no down payment.

You may have owned a home before and are presently renting, or maybe you are a first time homebuyer and need a way to break into the housing market but are holding back because you think you require $10.000, $20.000 or even more for a down payment.

Well regardless of your present situation, if you want to get into, or re-enter the housing market without having to make a cash down payment, this new program may be just what you're looking for. Why pay your landlord's mortgage when you can be building your own equity.

Industry insiders have prepared a new special report entitled, "How to Buy a Home With Zero Down' which reveals how this new and innovative program can get you into the housing market immediately and with no down payment.

To get your FREE copy today visit

www.LVRealDeal.com

or call 877-583-1181 ID#712

FHA is changing the maximum amount of the loan!

Starting January 1, 2009 the max FHA loan limit for Clark County is $287,500.00. If you are shopping for a home using FHA financing that will exceed this limit we need to get the offers in place NOW because we need to LOCK the loan by 12/10/2008 and FUND by 12/31/2008 to be able to get you the perfect home. CALL ME!

Monday, November 3, 2008

*****FORECLOSURES*************************

DISTRESS SALE

Bank Foreclosures

FREE list of Bank-owned properties

Receive a FREE computerized daily update

Visit: www.LVRealDeal.com to find out more

Bank Foreclosures

FREE list of Bank-owned properties

Receive a FREE computerized daily update

Visit: www.LVRealDeal.com to find out more

| | |||

Sunday, November 2, 2008

November 2008 update

If you are having hard time reading the text on this post, please click on it and it'll take you to a separate page and then click again and that will increase the size of the text! Thank you for visiting my blog and please leave your comments!

Sunday, October 12, 2008

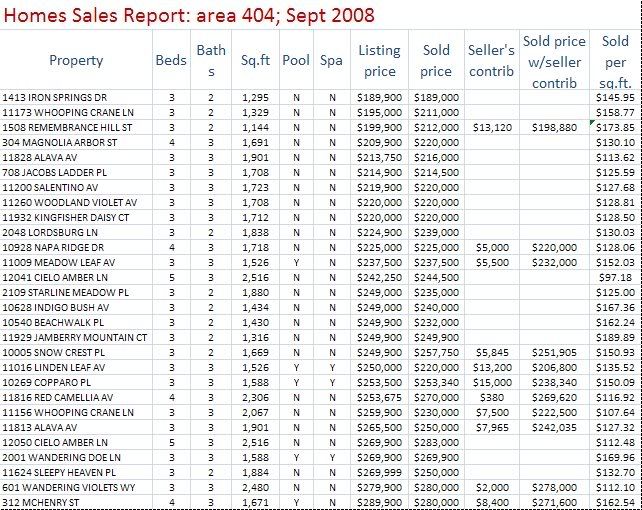

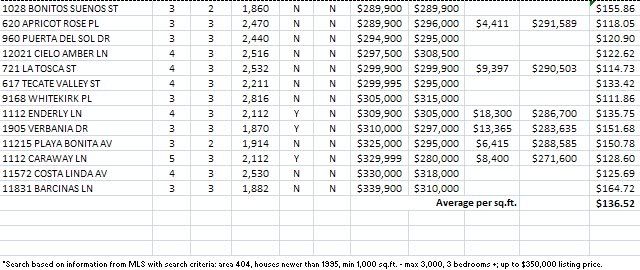

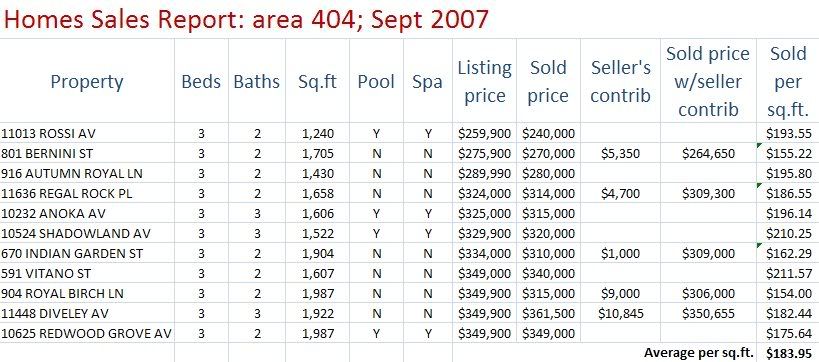

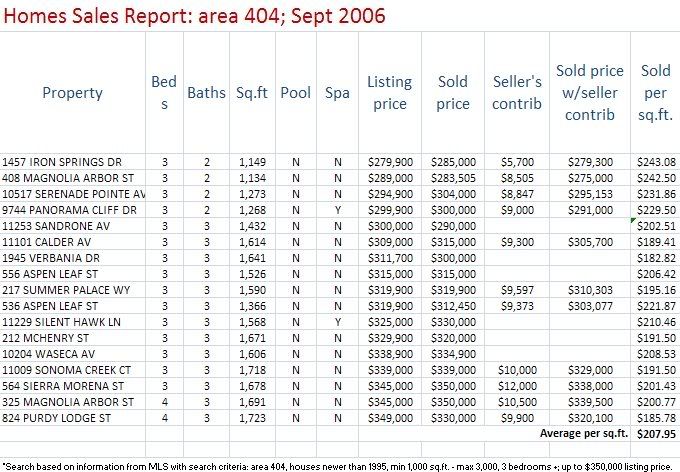

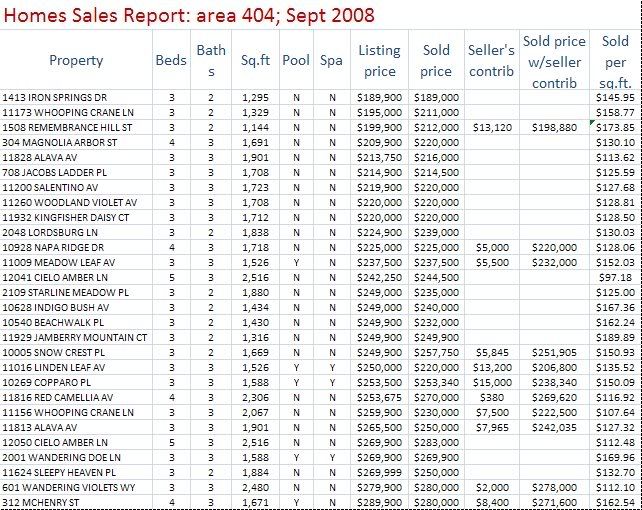

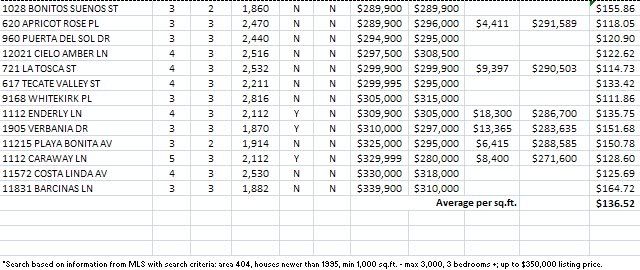

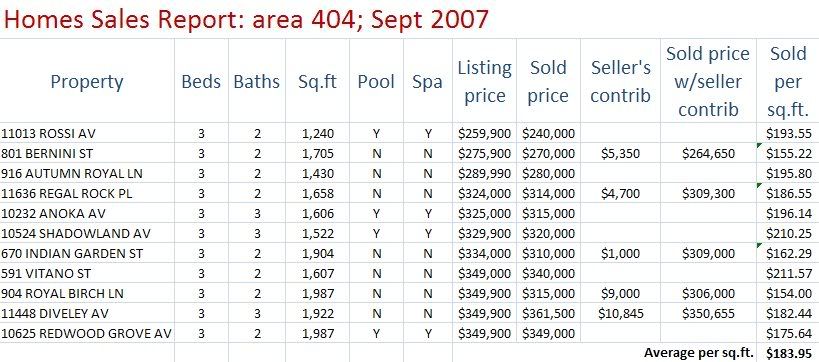

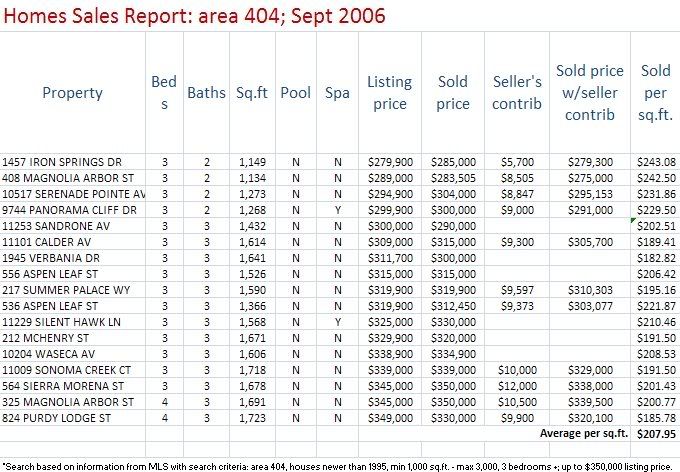

SALES TRENDS in part of the Summerlin Area - September '08, '07 & '06

Here I compared the average sales for North Summerlin area (404) for September 2008, 2007 & 2006. As you can see, this year the average price per square foot dropped to $137 compared with September 2007 - $186 (see below) and September 2006 - $208 (see below).

If you'd like to find out what's been happening to the pricing in your neighborhood, please email me with request: MarinaGulakova@gmail.com

If you'd like to find out what's been happening to the pricing in your neighborhood, please email me with request: MarinaGulakova@gmail.com

Tuesday, October 7, 2008

Wednesday, October 1, 2008

Tuesday, September 30, 2008

100% financing is back! It’s legitimate, it’s helpful, and it’s back.

So, we have a 100% financing program back!!! It’s legitimate, it’s helpful, and it’s back.

Since the government decided to “kill” even further the real estate business with the cancellation of Nehemiah program, we thought that a big portion of folks won’t be able to afford homes any longer. Some may argue that if people can’t afford even 3% down payment (the requirement for FHA loans) and require assistance on paying the closing costs as well, then they shouldn’t be buying a home to begin with as they obviously can’t afford it! Well, I think it’s just one of the ways of leveraging available cash: the less cash you put towards the purchase, the more you have left for renovating the place or acquiring more properties.

It works simply as any other FHA program would. This 100% program allows you to borrow additional money to cover your down payment and /or closing costs at 2% above first mortgage rate up to $10,000 max.

Let’s look at the example:

Say, you want to buy a property for $165,000.

Down payment of 3% required : $4,950 (although the new law states that the down payment should be at least 3.5%, some lenders are still lending with 3% down payment only)

Closing costs: $4,950

Inspection and appraisal: $350 + $250 = $600 (we are assuming the appraisal is not reimbursed by the seller)

Total cash required: $10,500 needed to purchase - Down payment and closing costs assistance of up to $9,900 = $600

Financing:

$165,000 – $4,950 down payment = $160,050; this is the amount that needs to be financed under standard FHA program. The other $9,900 (for down payment and/or closing costs) will be financed for 20 years only and at a rate 2% higher than your APR.

****Let’s assume the APR rate is 6.5%, annual property taxes are $2,200 (I know it seems high, but currently it’s one of the problems with properties in LV – the prices have fallen, but the property taxes were assessed based on previous values of the properties which were higher; eventually, the property taxes should come down significantly or you can appeal to have your property taxes reassessed), the loan term is 30 years fixed.

Your payments for loans would be: $1,012 (for 1st loan) + $86 (2nd loan) = $1,098

Plus taxes of $183, your monthly payment is $1,281. We should also add HOA fee to this equation, however, the HOA fees vary greatly. Let’s assume the HOA in this case is $30.

THE TOTAL PAYMENT IS: $1,311.

This is not bad, as the rent for such a home would be about $1,300 - $1,500/m.

This program allows you to have little or no cash upfront.

If you’d like more information on this program, let me know!

****Some restrictions and limitations might apply.

Since the government decided to “kill” even further the real estate business with the cancellation of Nehemiah program, we thought that a big portion of folks won’t be able to afford homes any longer. Some may argue that if people can’t afford even 3% down payment (the requirement for FHA loans) and require assistance on paying the closing costs as well, then they shouldn’t be buying a home to begin with as they obviously can’t afford it! Well, I think it’s just one of the ways of leveraging available cash: the less cash you put towards the purchase, the more you have left for renovating the place or acquiring more properties.

It works simply as any other FHA program would. This 100% program allows you to borrow additional money to cover your down payment and /or closing costs at 2% above first mortgage rate up to $10,000 max.

Let’s look at the example:

Say, you want to buy a property for $165,000.

Down payment of 3% required : $4,950 (although the new law states that the down payment should be at least 3.5%, some lenders are still lending with 3% down payment only)

Closing costs: $4,950

Inspection and appraisal: $350 + $250 = $600 (we are assuming the appraisal is not reimbursed by the seller)

Total cash required: $10,500 needed to purchase - Down payment and closing costs assistance of up to $9,900 = $600

Financing:

$165,000 – $4,950 down payment = $160,050; this is the amount that needs to be financed under standard FHA program. The other $9,900 (for down payment and/or closing costs) will be financed for 20 years only and at a rate 2% higher than your APR.

****Let’s assume the APR rate is 6.5%, annual property taxes are $2,200 (I know it seems high, but currently it’s one of the problems with properties in LV – the prices have fallen, but the property taxes were assessed based on previous values of the properties which were higher; eventually, the property taxes should come down significantly or you can appeal to have your property taxes reassessed), the loan term is 30 years fixed.

Your payments for loans would be: $1,012 (for 1st loan) + $86 (2nd loan) = $1,098

Plus taxes of $183, your monthly payment is $1,281. We should also add HOA fee to this equation, however, the HOA fees vary greatly. Let’s assume the HOA in this case is $30.

THE TOTAL PAYMENT IS: $1,311.

This is not bad, as the rent for such a home would be about $1,300 - $1,500/m.

This program allows you to have little or no cash upfront.

If you’d like more information on this program, let me know!

****Some restrictions and limitations might apply.

Wednesday, September 17, 2008

Sunday, September 7, 2008

Saturday, August 16, 2008

Wednesday, August 6, 2008

Thursday, July 24, 2008

Subscribe to:

Posts (Atom)